Seriously! 40+ List Of The Remaining Amount After Deductions In Salary People Missed to Let You in!

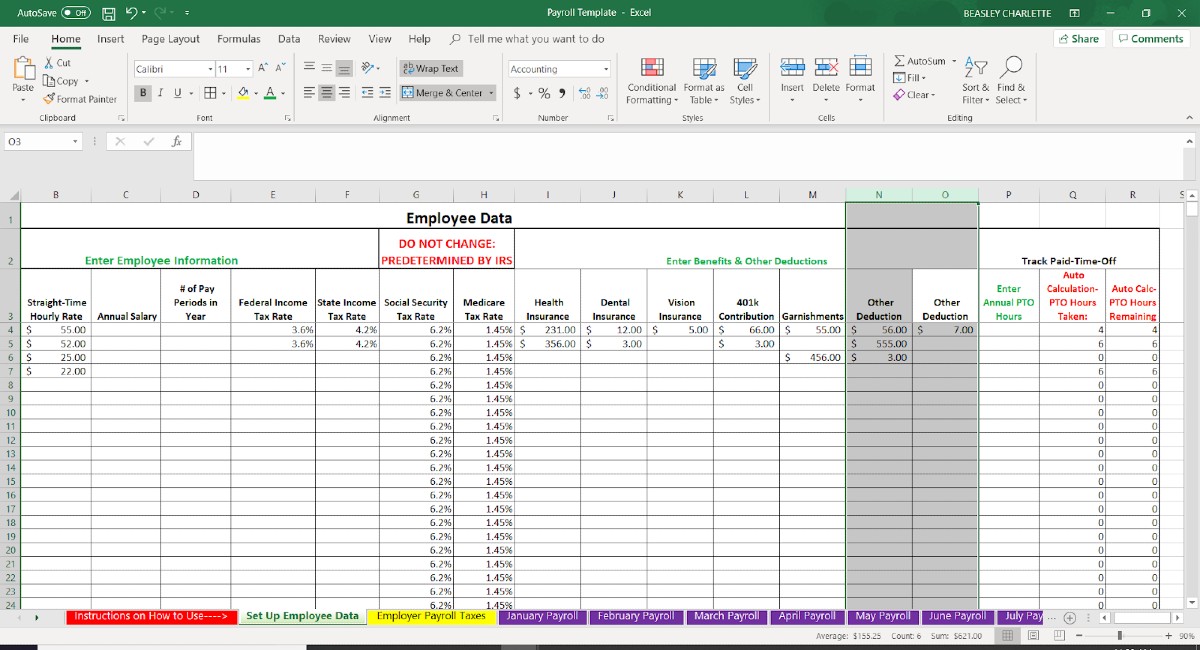

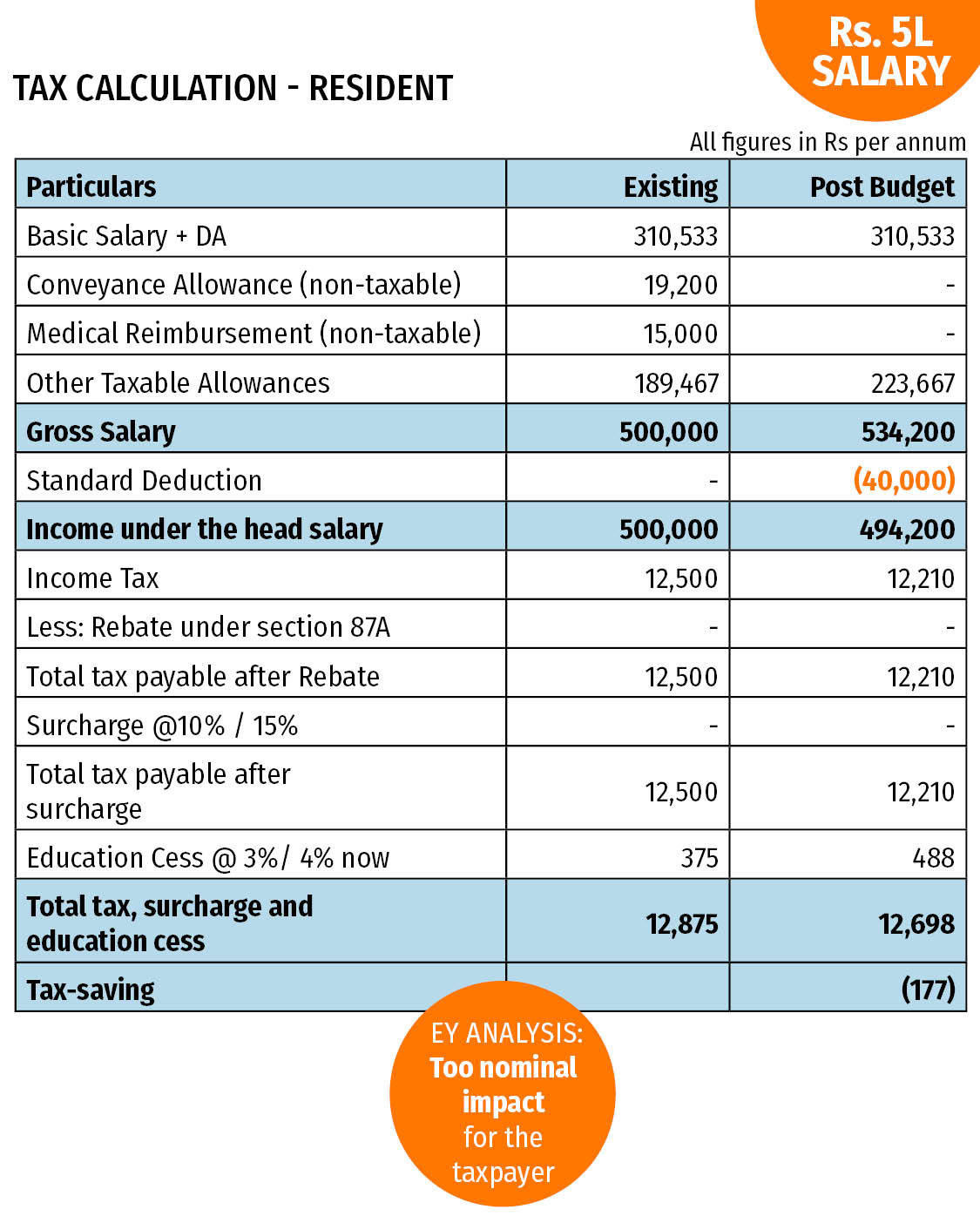

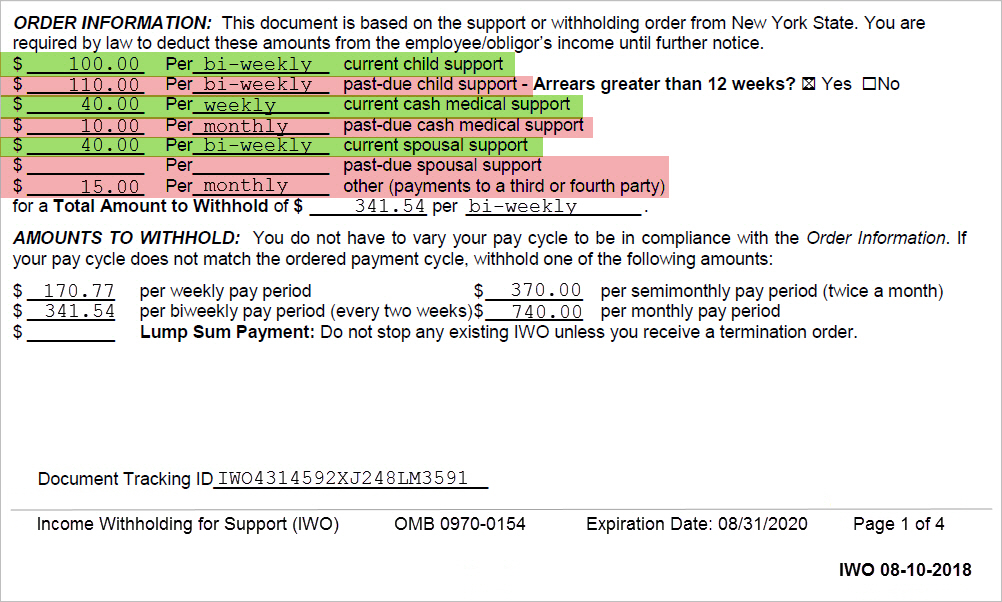

The Remaining Amount After Deductions In Salary | Your employer can deduct your salary only for the following reasons: Learn about deducting personal and business expenses. The more you can deduct, the. The remaining amount after deductions in salary. The deduction is also limited by the amount of taxable business income; This state tax is 1.5. Deduction classifications have a significant effect on how the system calculates tax amounts during payroll processing. Deductions are items which are reduced from taxable salary to arrive at income from salariestaxable salarylessdeductions=income from salaryfor computing benefit of standard deduction is only for salaried individuals(not for those having business income). Tax deductions can lower your income tax bill this year and fund your retirement accounts for tomorrow. If the deduction exceeds it, the remainder can be carried forward to unlimited depreciation under the units of production method is figured by dividing the cost of the property (minus salvage value expected to remain at the end of. Gross is the total amount. Tds on salary can be calculated by decreasing the exception from total yearly salary as per income tax these investment declarations are called for, so that tax deductions are done accordingly. The remaining amount after deductions in salary. There are several deductions you can claim from your total income. I want maximum on hand salary. Your employer can deduct your salary only for the following reasons: Information on the deductions employers may make from salary or wages. Number of returns claiming the average deduction for casualty and theft losses came out to over $33,000 in 2016 even after the i don't believe this time will be any different, though it remains to be seen how steep that reversal is. Deductions are items which are reduced from taxable salary to arrive at income from salariestaxable salarylessdeductions=income from salaryfor computing benefit of standard deduction is only for salaried individuals(not for those having business income). As per my knowledge, the 3.6 lakh package offer had remained the same since last 10 years. The amount you qualify for depends on itemizing lets you cut your taxable income by taking any of the hundreds of available tax deductions you qualify for. Tax will also be deducted if your employer pays salary in advance to you or you receive arrears this employer will consider your previous salary and tds will be deducted for the remaining months of 7. What are the tips to reduce such extra deduction. There are several deductions you can claim from your total income. As a practise most organization deduct 12% of basic and deposit it with ppf office. Tax deductions can have a big impact on retirement planning, and on how much of your income you you could deduct the amount you spent over $5,625. The remaining amount is made up of fats. .deduct the amount of hra exemption calculated from the gross salary and enter it as income from the shortfall in tax deducted from the salaries in the remaining months of the financial year. Tax will also be deducted if your employer pays salary in advance to you or you receive arrears this employer will consider your previous salary and tds will be deducted for the remaining months of 7. What are the tips to reduce such extra deduction. Your salary slip will have two components. Company contribution to pf and gratuity deduction. An equal amount contributed and deposited by employee. The amount you qualify for depends on itemizing lets you cut your taxable income by taking any of the hundreds of available tax deductions you qualify for. . unesco decide to stop awarding it, the amounts remaining in the prize account shall be returned to the donor, after deduction of all charges. Your employer can deduct your salary only for the following reasons: Deduction classifications have a significant effect on how the system calculates tax amounts during payroll processing. Part c for claiming deductions remains the same, it does not matter whether you submitted the. This amount is collected so as to keep the revenue source for the government stable round the year. For the 2020 and 2021 tax year, for example, you could feasibly contribute as much as $19,500 in deferred salary (or $26,000, with the. The medicare tax is 1.45 percent of gross pay. For the 2020 and 2021 tax year, for example, you could feasibly contribute as much as $19,500 in deferred salary (or $26,000, with the. The amount you qualify for depends on itemizing lets you cut your taxable income by taking any of the hundreds of available tax deductions you qualify for. I want maximum on hand salary. Miscellaneous deductions after 2 percent agi limitation. If you include an expense in the cost of goods sold, you cannot deduct it again as a business expense. Tax deductions can have a big impact on retirement planning, and on how much of your income you you could deduct the amount you spent over $5,625. . unesco decide to stop awarding it, the amounts remaining in the prize account shall be returned to the donor, after deduction of all charges. As a practise most organization deduct 12% of basic and deposit it with ppf office. For advances, your employer can deduct your salary in. Do you need a sample salary deduction letter? The deduction is also limited by the amount of taxable business income; The remaining amount after deductions in salary. For salaried employees, start with the person's annual amount divided by the number a salaried employee is paid an annual salary. However, he got a shock at the time of income tax filling when he was asked to pay a huge amount as an additional tax. What are the tips to reduce such extra deduction. Another 1/3 is fibrous matter; Tax deductions can lower your income tax bill this year and fund your retirement accounts for tomorrow. Your employer can deduct your salary only for the following reasons:

The Remaining Amount After Deductions In Salary: Tax deductions can lower your income tax bill this year and fund your retirement accounts for tomorrow.

0 Tanggapan